massachusetts meal tax calculator

Massachusetts doesnt have local sales tax rates only a statewide tax rate of 625. Federal labor law requires overtime hours be paid at 15 times the normal hourly rate.

Massachusetts Vehicle Sales Tax Fees Calculator Find The Best Car Price

The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location.

. Sales tax is a tax paid to a governing body state or local for the sale of certain goods and services. Our Massachusetts Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the average property tax on similar properties in Massachusetts and across the entire United States. For more information please visit massgovdor.

The local meals and beverage tax is administered and collected by the ri division of taxation. Selling meals within Massachusetts due to sales tax is considered a job of a meals tax vendor in the state. The Massachusetts income tax rate is 500.

First enacted in the United States in 1921 sales tax dates back to ancient Egyptian times where paintings depict the collection of tax on commodities. The maximum tax that can be enacted on meals in Massachusetts compares favorably to that in other New England states. The Massachusetts MA state sales tax rate is currently 625.

Thats why we came up with this handy. So you would simply charge the state sales tax rate of 625 to buyers in Massachusetts. The Massachusetts Department of Revenue is responsible.

The IRS says on its website that under Section 179 of the tax code the TCJA increased the maximum Section 179. 54 rows A sales tax is a consumption tax paid to a government on the sale of certain goods and services. Taxes for meals are 6 percent.

To use the calculator just enter your propertys current market value such as a current appraisal or a recent. Massachusetts is a flat tax state that charges a tax rate of 500. The meals tax rate is 625.

Find your Massachusetts combined state and local tax rate. Anyone who sells meals that are subject to sales tax in Massachusetts is a meals tax vendor If a liquor license holder operates a restaurant where meals are served the holder of the license is presumed to be the meals tax vendor whether the meals are served by the license holder or a concessionaire. This breakdown will include how much income tax you are paying state taxes federal taxes and many other costs.

Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to Massachusetts local counties cities and special taxation districts. A 625 state meals tax is applied to restaurant and take-out meals. The Massachusetts State Tax Tables for 2021 displayed on this page are provided in support of the 2021 US Tax Calculator and the dedicated 2021 Massachusetts State Tax CalculatorWe also provide State Tax Tables for each US State with supporting tax calculators and finance calculators tailored for each state.

After a few seconds you will be provided with a full breakdown of the tax you are paying. Massachusetts local sales tax on meals. Local tax rates in Massachusetts range from 625 making the sales tax range in Massachusetts 625.

Connecticuts meals tax is 635 percent followed by Massachusetts and Maine at 7 percent then Rhode Island at 8 percent New Hampshire at. That goes for both earned income wages salary commissions and unearned income interest and dividends. Depending on the type of retailer and what part of the store counts as a restaurant Massachusetts applies a sales tax to meals sold in restaurants.

In most countries the sales tax is called value-added tax VAT or goods and services tax GST which is a different form of consumption tax. The Massachusetts State Tax Tables for 2016 displayed on this page are provided in support of the 2016 US Tax Calculator and the dedicated 2016 Massachusetts State Tax CalculatorWe also provide State Tax Tables for each US State with supporting tax calculators and finance calculators tailored for each state. Massachusetts sales tax rates vary depending on which county and city youre in which can make finding the right sales tax rate a headache.

More than 40 percent of all Massachusetts cities and towns now assess the 075 local tax on meals. After a few seconds you will be provided with a full breakdown of the tax you are paying. Usually the vendor collects the sales tax from the consumer as the consumer makes a purchase.

The Massachusetts Department of Revenue is responsible. The statewide sales tax rate of 625 is among the 20 lowest in the country when including the local taxes collected in many other states. This is true whether you are based in Massachusetts or whether you are based in another state and have sales tax nexus in Massachusetts.

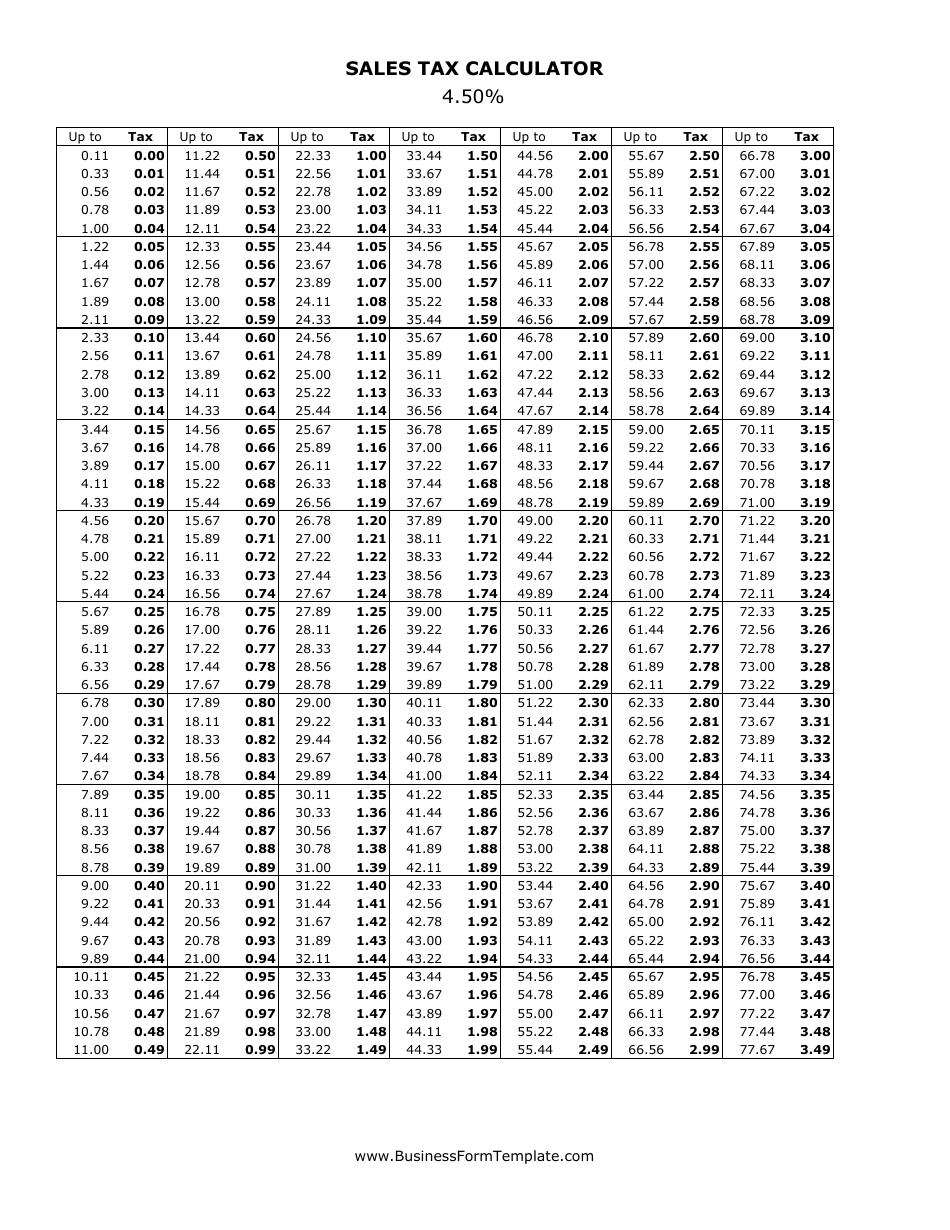

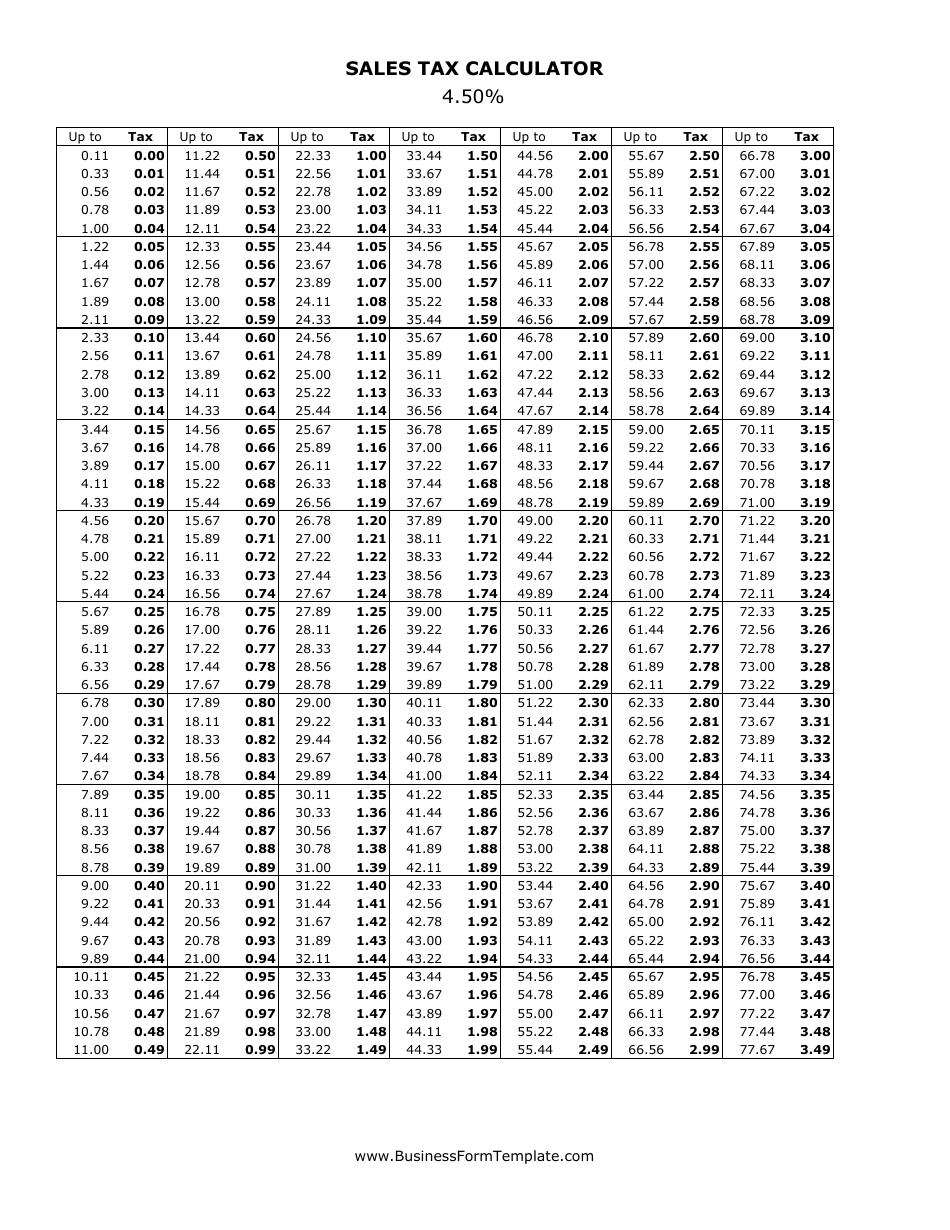

A sales tax table is a printable sheet that you can use as a reference to easily calculate the sales tax due on an item of any price - simply round to the nearest 020 and find the row in the sales tax chart that shows the applicable tax for that amount. As provided in the Meal and Rest Break Policy requirements vary by state. Business purchases for resale are also exempt with the use of a Sales Tax Resale Certificate Form ST-4 completed by the buyer.

Massachusetts has a 625 statewide sales tax rate and does not allow local. You can use our Massachusetts Sales Tax Calculator to look up sales tax rates in Massachusetts by address zip code. What Is The Meal Tax In Massachusetts.

A local option meals tax of 075 may be applied. Food clothing items under 175 admissions sales and most utilities and heating fuel are exempt from the Massachusetts sales tax. A financial advisor in Massachusetts can help you understand how taxes fit into your overall financial goals.

The state sales tax rate in Massachusetts is 625 but you can customize this table as. Please contact the Internal Revenue Service at 800-829-1040 or visit wwwirsgov. To use our Massachusetts Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button.

Massachusetts local sales tax on meals more than 40 percent of all massachusetts cities and towns now assess the 075 local tax on meals. No Massachusetts cities charge their own local income tax. Hotel rooms state tax rate is 57 845 in Boston Cambridge Worcester Chicopee Springfield and West Springfield A local option rooms tax of up to 6 may be applied.

Amazon Sales Tax What It Is How To Calculate Tax For Fba Sellers

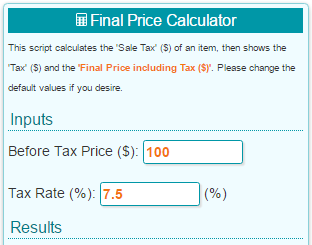

Free Business Sales Tax Calculator Calculate Your Tax Now With Clickfunnels

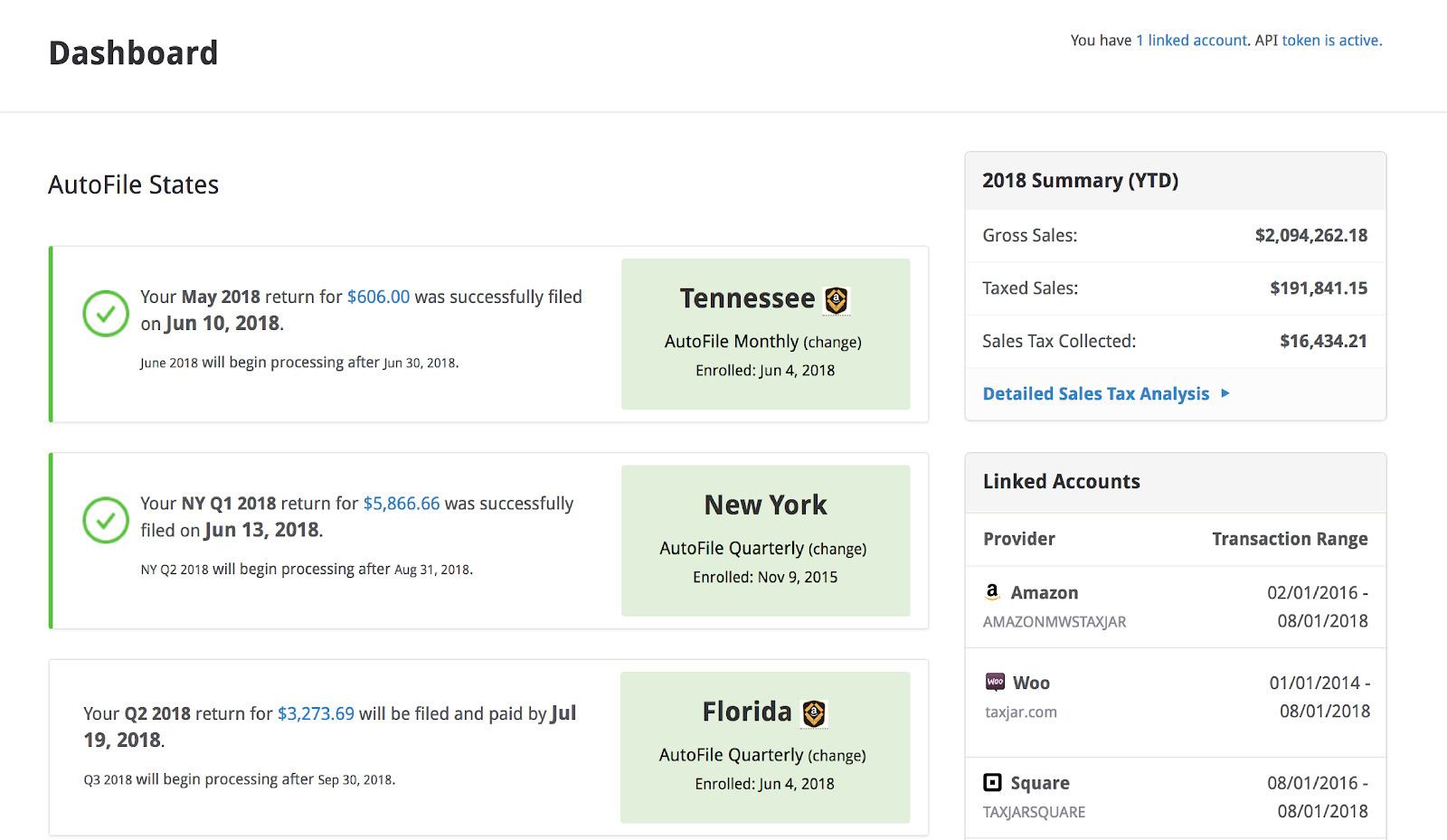

Woocommerce Sales Tax In The Us How To Automate Calculations

How To Calculate Sales Tax Video Lesson Transcript Study Com

Sales Tax By State Is Saas Taxable Taxjar

Item Price 65 Tax Rate 6 Sales Tax Calculator

Massachusetts Sales Tax Calculator Reverse Sales Dremployee

How To Calculate Cannabis Taxes At Your Dispensary

Massachusetts Sales Tax Small Business Guide Truic

Sales Tax Calculator For Purchase Plus Tax Or Tax Included Price

Massachusetts Sales Tax Calculator Reverse Sales Dremployee

Car Tax By State Usa Manual Car Sales Tax Calculator

Excise Tax What It Is How It S Calculated

Car Tax By State Usa Manual Car Sales Tax Calculator

Income Tax Calculator 2021 2022 Estimate Return Refund

Massachusetts Income Tax Calculator Smartasset Com Income Tax Income Tax

How To Calculate Cannabis Taxes At Your Dispensary

4 5 Sales Tax Calculator Download Printable Pdf Templateroller